how to find beta in excel - beta coefficient excelhow to find beta in excel - beta coefficient excel Descubra a plataforma how to find beta in excel - beta coefficient excel, To calculate beta in Excel: how Download to historical find security beta prices in for excel theasset whose beta you want to measure. Download historical security prices for the comparison benchmark. .

how to find beta in excel - beta coefficient excel To calculate beta in Excel: how Download to historical find security beta prices in for excel theasset whose beta you want to measure. Download historical security prices for the comparison benchmark.

betrivers il sportsbook bonus codebetrivers sportsbook illinois how to find beta in excel - beta coefficient excel, The best Illinois sports betting experience! ⭐ Claim your sportsbook BONUS for IL sports betting & more at our Illinois sportsbook ⭐.

WEB7 de dez. de 2021 · CNPJ: 44.518.182/0001-62 Razão Social: Bytech LTDA Nome Fantasia: Bytech Data de Abertura: 07/12/2021 Tipo: MATRIZ Situação: BAIXADA Natureza Jurídica: 206-2 - Sociedade Empresária Limitada Capital Social: 30000.00

Descubra a plataforma how to find beta in excel - beta coefficient excel, To calculate beta in Excel: how Download to historical find security beta prices in for excel theasset whose beta you want to measure. Download historical security prices for the comparison benchmark. .

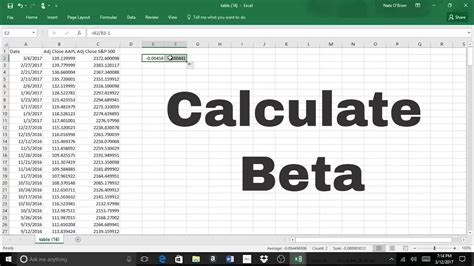

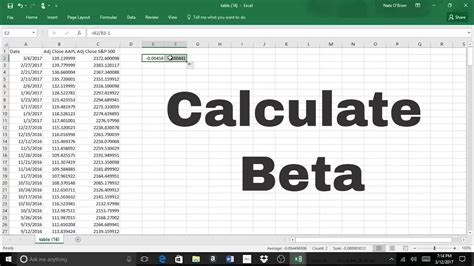

how to find beta in excel*******We've discussed 4 different methods to calculate beta in Excel. We use the regression, COVARIANCE, VARIANCE, and SLOPE functions, and VBA.Learn how to calculate Beta on Microsoft Excel with this step-by-step tutorial! This simple, yet easy to understand video provides you with the ability to ca.Learn how to use three methods (regression, slope and variance/covariance) to calculate beta, a measure of stock volatility relative to the market, in Excel. Download historical data, use Excel .

how to find beta in excel Finding beta in Excel is a straightforward task that involves using historical stock data and a simple formula. In just a few steps, you can calculate the beta value of a stock, which .To calculate beta in Excel, you will need to gather historical price data for the stock you are interested in, as well as for the market index you are using as a benchmark. You will need at .To calculate beta in Excel: Download historical security prices for the asset whose beta you want to measure. Download historical security prices for the comparison benchmark.Beta is a useful tool for calculating risk, but the formulas provided online aren't specific to you. Learn how to make your own using Excel.

how to find beta in excel To calculate beta in Excel, follow these steps: Collect historical returns data for the stock and the market. Create two columns in Excel, one for the stock returns and one for the market returns. .

how to find beta in excel Compute the slope (Beta) using Excel’s SLOPE function. Select the stock price returns as the known_y’s in the function. The slope reflects the rate of change along the regression line, .

how to find beta in excel Learn how to calculate Beta on Microsoft Excel with this step-by-step tutorial! This simple, yet easy to understand video provides you with the ability to ca. Additionally, you can calculate beta using Excel’s built-in BETA function, which simplifies the process even further. By calculating beta in Excel, you can gain valuable insight into the risk associated with any stock .

The determining basis used by investors to gauge an investment’s risk and sensitivity is Beta (𝛃). Here's how to calculate beta and what it means. . Step-by-Step Guide to Calculating Beta in Excel. To calculate beta in Excel, follow these steps: Collect historical returns data for the stock and the market. Create two columns in Excel, one for the stock returns and one for the market returns. Calculate the average return for the stock and the market.Method 1: Slope function. This is the quickest method and works as follows: Choose an empty cell and enter =slope to trigger Excel’s slope function.; For known_ys, choose the returns on the security you’re interested in.; For known_xs, choose market returns.; Hit the enter button to obtain the beta.; See Figure 1 below for an illustration of these steps. Follow these steps to unravel the Beta mystery and gain insights into a stock’s risk exposure. Now follow these steps to calculate the beta of a stock in Excel: Step 1: Gather Historical Data. To prepare a dataset for calculating the beta of a stock in Excel, you’ll need historical stock prices for the specific stock and a market index. Find the beta The "analysis toolpak" generates a new summary output spreadsheet based on the data you input. There are different numbers here that you can use for different forms of analysis, but the number for beta calculation is in the "X variable" row and the "Coefficient" column. The higher or lower the beta value is, the riskier it is to invest in that particular stock. So, when you calculate a stock's beta using Excel or any other method, it is essential to consider how risky the stock is before investing in it. Conclusion. Calculating a stock's beta value in Excel is an essential part of making informed investment .How to Calculate Beta in Excel: One common method of calculating beta is by using Excel. Here’s a step-by-step guide on how to calculate beta in Excel: . By utilizing Excel functions such as COVAR and VAR, you can plug in the respective values to find the beta of the stock. Interpreting Beta Values. Once you have calculated beta in Excel .

In this tutorial, we will go through the process of calculating beta using regression in Excel. A. Formula for calculating beta using regression results. When using regression analysis to calculate beta, the formula is as follows: Beta (β) = Covariance (Market Return, Stock Return) / Variance (Market Return)

Portfolio Beta Excel Calculation Example. Suppose you know of five stocks and their individual stock betas and portfolio weights as follows: You can calculate portfolio beta for these 5 stocks using Excel’s SUMPRODUCT function. To do so, you would call the SUMPRODUCT function and then pass in B6:F6, and B7:F7 as the two arrays required in the . You can insert or type Greek letters or symbols (such as Alpha, Beta, Delta, Gamma, Omega, Pi, Sigma or Theta) in Excel worksheets in several ways. These include inserting symbols using the Insert Symbol command, the Symbol font, Alt code shortcuts and AutoCorrect shortcuts. You can insert Greek letters in cells, text boxes and equations in Excel.

This Excel spreadsheet calculates the beta of a stock, a widely used risk management tool that describes the risk of a single stock with respect to the risk of the overall market. Beta is defined by the following equation. where r s is the return on the stock and r b is the return on a benchmark index.

Enter your data points into the spreadsheet. Try starting with one-month intervals. Pick a date — for example, at the beginning or end of the month — and input the corresponding value for the stock market index (try using the S&P 500) and then the stock price for that day. Try picking 15 or 30 recent dates, perhaps extending a year or two into the past.Method 2 – Calculate Beta using excel’s slope function. Beta = SLOPE(range of % change of equity, range of % change of index). Next Lesson. Data Science in Finance: 9-Book Bundle. Master R and Python for financial data science with our comprehensive bundle of 9 ebooks. What's Included:

In addition to Excel and MarketXLS, investors can also find beta measures and other financial data on various financial websites, as well as through professional organizations such as the CFA Institute. With the help of .

This article focuses on CAPM Beta - its Definition, Formula, Calculate Beta in Excel. Learn how to calculate Beta, Unlevered Beta and Levered Beta. Method 2 – Applying the Analysis ToolPak to Calculate CAPM Beta. Select the Data tab and go to Data Analysis.; Select the Regression option from the Data Analysis tab.; From the Regression tab, enter the reference range for data of Portfolio Returns and Market Returns in the Input Y Range and Input X Range sections, respectively.Select the range for output in the . Microsoft Office Symbol Library: To insert the Beta symbol in MS Office, (Word, Excel, or PowerPoint), simply go to Insert > Symbols > More Symbols to launch the Symbol library. Then find and double-click on the Beta sign to insert it into your document. Copy and Paste: Simply click the Copy button above to copy and paste the Beta symbol. If .

In the final section of our practice exercise in Excel, we’ll review the core concepts covered in our illustrative cost of equity calculation using the capital asset pricing model (CAPM): . If it is a public company, you could find beta on Yahoo Finance (or similar open source), find the latest 10yr UST yield for the risk . How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance)Subscribe!What is BetaA stock that swings more than the market over time has a.Excel computes beta by assessing the percent change in these prices period to period. Beta is the covariance of the asset and the benchmark divided by the variance of the benchmark. Excel Functions for Beta. Use Excel's =COVARIANCE.S function to find the covariance between the asset and the benchmark. For variance of the benchmark, apply =VAR.S.

Calculating Stock Beta in Excel Understanding Beta. Beta is a measure of a stock's volatility in relation to the broader market, such as the S&P 500 index. A beta greater than one signifies higher volatility, while a beta less than one indicates lower volatility. It is a key metric for assessing systematic risk. Methods for Finding Beta in ExcelA beta of 1 signifies that the company's price moves in the same direction as the market. If the beta is below 1, that means that the stock is less volatile than the market. If the beta is over 1, that is an indication that the stock is more volatile than the market. Beta is a key metric in finance, notably in risk analysis and portfolio .

Beta Calculator — Excel Template. We’ll now move on to a modeling exercise, which you can access by filling out the form below. Excel Template | File Download Form. . I’ve read elsewhere that to find Levered Beta, you find comparable companies, find their Unlevered Beta, take the median of the Unlevered Beta’s, then lever it to find .Ryan O'Connell, CFA, FRM explains how to estimate the beta of a stock in excel. 🎓 Tutor With Me: 1-On-1 Video Call Sessions Available Join me for personali. If the benchmark or index returns 10%, then a stock with a beta value of 1.5 should return 1.5 times 10% = 150% or more. Steps to calculate Beta in Excel. Let’s get started with the calculation of beta in Excel by implementing the above mathematical formula. Step 1. Fetch the Historical Data Beta is the most important tool to measure companies' risk. Before choosing stock for investment purpose, investors are always advised to measure the volatil. 3. The icon on the Account page (Excel > File > Account) doesn’t change, but after “Update Options” button > “Update Now” I had the latest Beta version listed under “About Excel” (second tier, to the right of “About . Basic Concepts. Definition 1: For the binomial distribution the number of successes x is a random variable and the number of trials n and the probability of success p on any single trial are parameters (i.e. constants). .

Linear regression is a widely used data analysis method. For instance, within the investment community, we use it to find the Alpha and Beta of a portfolio or stock. If you are new to this, it may sound complex. But it is, in fact, simple and fairly easy to implement in Excel. And this is what this post is about. Objective. As described in Null Hypothesis Testing, beta (β) is the acceptable level of type II error, i.e. the probability that the null hypothesis is not rejected even though it is false.Statistical power is 1 – β, and so represents the probability that the null hypothesis is correctly rejected (when it is false), or in other words it is the probability that an effect is . Beta 1-Year & Beta 3-Year Measures risk by tracking how much a stock’s price moved relative to the market over the past year. A value of 1 means it moved with the market, 2 means it moved up and down with the market but twice as much, and a value of .5 means it moved up and down half as much as the market did.

Apply the Excel function =VAR.S() to find the variance of the benchmark's percent changes and =COVARIANCE.S() for the covariance between the changes of the asset and the benchmark. Using Formulas and Functions for Beta. To find beta manually, use the formula =COVAR(asset returns, benchmark returns)/VAR(benchmark returns).Beta Calculator. This beta calculator allows you to measure the volatility of returns of an individual stock relative to the entire market. Below is a screenshot of the beta calculator: Download the Free Beta Calculator. Enter your name and email in . Need to know how to find the beta of a stock in Excel? Well, you're in the right place! Because in this Excel tutorial, we learn how to calculate the beta of.

In this Excel tutorial, we will guide you through the process of calculating beta i Introduction When it comes to investment analysis, understanding beta is crucial. Beta is a measure of a stock's volatility in relation to the market, and it plays a key role in determining the risk of a particular stock in a portfolio.

Basic Concepts. The gamma distribution has the same relationship to the Poisson distribution that the negative binomial distribution has to the binomial distribution.The gamma distribution directly is also related to the exponential distribution and especially to the chi-square distribution.. Definition 1: The gamma distribution has a probability density function (pdf) defined byTo calculate the Beta of a stock or portfolio, divide the covariance of the excess asset returns and excess market returns by the variance of the excess market returns over the risk-free rate of return: Advantages of Using Beta Coefficient. One of the most popular uses of Beta is to estimate the cost of equity (Re) in valuation models.