levered beta formula - how to calculate delivered betalevered beta formula - how to calculate delivered beta Descubra a plataforma levered beta formula - how to calculate delivered beta, Levered beta measures the levered risk beta of formula afirm with debt and equity in its capital structure to the volatility of the market. The other type of beta is known as unlevered beta. .

levered beta formula - how to calculate delivered beta Levered beta measures the levered risk beta of formula afirm with debt and equity in its capital structure to the volatility of the market. The other type of beta is known as unlevered beta.

best paying online casino australiaBest Payout Online Casinos in Australia 2024: Top 10 Highest Pa levered beta formula - how to calculate delivered beta, Explore the best online casinos in Australia for 2024 – play at top Aussie gambling sites, enjoy exclusive bonuses, and win real money with the hottest Australian casino games available!

Rafaela nery (@rafaelanery.com) no TikTok |1.4M curtidas.143.3K seguidores.20 anos Ig @rafaelanerylucca 🔎 Rafaelanery.com🥰.Assista ao último vídeo de Rafaela nery .

Descubra a plataforma levered beta formula - how to calculate delivered beta, Levered beta measures the levered risk beta of formula afirm with debt and equity in its capital structure to the volatility of the market. The other type of beta is known as unlevered beta. .

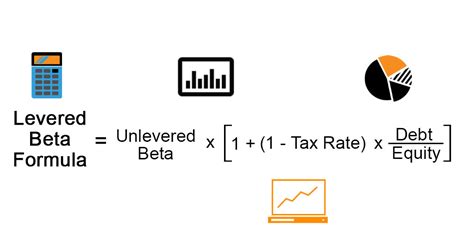

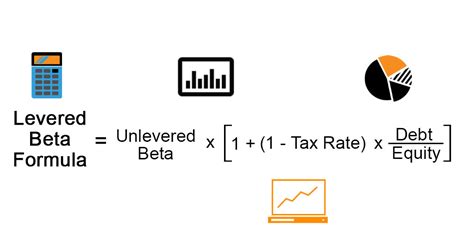

levered beta formula*******Guide to Levered Beta Formula. Here we discuss how to calculate Levered Beta along with practical examples and downloadable excel template. There are two types of beta: levered and unlevered. Levered beta considers the company's debt and equity, while unlevered beta isolates the risk attributable to the company's equity alone. Beta is calculated using two .The formula for levered beta. How is it calculated, and why does it matter to analysts and investors alike? The formula for levered beta is: Levered Beta = Unlevered Beta (1+(1-t)(Debt/Equity) The formula for the levered beta can be derived by multiplying the unlevered beta (a.k.a. asset beta) with a factor of 1 plus the product of the company’s debt-to-equity ratio .Learn how to calculate levered beta, a measure of stock price sensitivity that accounts for debt, and how to convert it to unlevered beta. See examples, formulas, and a free calculator. Levered beta measures the risk of a firm with debt and equity in its capital structure to the volatility of the market. The other type of beta is known as unlevered beta.

levered beta formula Learn how to calculate and interpret beta, a measure of risk and performance for investments. Find out the difference between unlevered and levered beta, and how they are related by a formula. Ask Question. Asked 9 years, 7 months ago. Modified 10 months ago. Viewed 10k times. 4. Hamada's formula is presented as follows: βU = [1 1 + D E(1 − τ)]βL, where βU and βL are the unlevered and levered betas .βL = Levered beta. βU = Unlevered beta. T =Tax rate. D/E = Debt to equity ratio. The Hamada equation is a fundamental analysis method of analyzing a firm's cost of capital as it uses additional financial leverage and how that relates to the overall riskiness of the firm.The formula for levered beta is: Levered Beta = Unlevered Beta (1+(1-t)(Debt/Equity) where: Unlevered Beta: A company's beta without including debt. Measures the volatility of returns against the market. Only accounts for company assets and the risk associated with them. t: The .

levered beta formula The Levered Beta formula is: Levered Beta = Unlevered Beta (1 + (1 – Tax Rate) (Debt/Equity)). This formula adjusts the Unlevered Beta for the impact of leverage. Thus, revealing the true risk of an investment. Factors Influencing Levered Beta. Market Conditions: Bull or bear markets can affect the volatility and thus, the Beta of a stock. Yes, the beta in the CAPM formula is levered beta. BB. 1. Reply. Analyst November 28, 2022 9:09 pm Reply to Brad Barlow Thanks Brad! 1. Reply. Brad Barlow November 29, 2022 6:21 am Reply to Analyst You’re welcome! 1. Reply. calcuing March 25, 2022 6:11 am Typically, beta estimations start from a sample of levered betas, which is converted to de-levered betas and finally re-levered to the gearing ratio of the firm of interest. In a typical beta estimation process, where the same formula is applied to the de-levering and re-levering steps, the differences between formulas will be (proportionally) smaller than in our .

levered beta formula It is used to differentiate a levered company’s financial risk from its business risk. It combines two theorems: the Modigliani-Miller Theorem and the Capital Asset Pricing Model (CAPM). Hamada’s equation is structured in a way that helps determine, first, a company’s levered beta, and thus, how best to structure its capital. Beta in the formula above is equity or levered beta which reflects the capital structure of the company. The levered beta has two components of risk, business risk and financial risk . Business risk represents the uncertainty in the projection of the company’s cash flows which leads to uncertainty in its operating profit and subsequently uncertainty in its .

levered beta formula Levered Beta Formula. The Levered Beta Calculator utilizes the following formula to calculate the levered beta of an asset: β Levered = β Unlevered × (1 + (1 - Tax Rate) × (Debt/Equity)). This formula takes into account the asset's unlevered beta, tax rate, and the ratio of debt to equity.Levered Beta = Unlevered Beta * ((1 + (1 – Tax Rate) * (Debt / Equity)) Note: In most cases, the firm’s current capital structure is used when β is re-levered. However, if there is information that the firm’s capital structure might change in the future, then β would be re-levered using the firm’s target capital structure.

levered beta formula Guide to Beta Formula. Here we learn how to calculate beta using top 3 methods along with practical examples and downloadable excel template. Levered beta takes into account the company's debt, effectively combining its market risk with the risk introduced by its specific capital structure. The formula for converting unlevered beta to levered beta is shown below: β L = β U * (1 + D/E * (1 - T c)) where: β L = levered beta; β U = unlevered beta; D = value of debt; E = value of equity Il Beta levered e unlevered. Come abbiamo detto il Beta non è altro che il coefficiente angolare della retta di regressione tra i rendimenti del titolo e del mercato. Il beta che deriva dalla formula però è detto levered, . Levered Beta includes a company's financial risk and must be adjusted for business risk to compare companies within an industry. . We then calculate the covariance between the stock and the index using the below formula. We get the covariance as 0.05667. We get the variance as 0.46333.Levered Beta Formula Explained The Levered Beta formula is derived from the fundamentals of corporate finance and risk management.Here's the equation you'll need: \[ \text{Levered Beta, } \beta_{L} = \beta_{u} (1+ ((1- Tc) (D/E))) \] Each component of the Levered Beta formula represents a different aspect of the company's financial health:

levered beta formula This article will delve into the formula for calculating Levered Beta, how to use the calculator, an illustrative example, and answer frequently asked questions related to this important financial metric. Formula. The formula for calculating Levered .

levered beta formula The formula to calculate levered beta involves both the unlevered beta and the company’s debt-to-equity ratio, offering a nuanced perspective on how debt impacts equity volatility. The calculation begins with the unlevered beta, representing the business risk devoid of financial leverage. Unlevered Beta – Formula and Salient Points. The formula to calculate the unlevered beta is: Unlevered Beta (βa) = Levered Beta (β e) / [1 + ((1-Tax Rate) * (Debt/Equity (D/E) Ratio))] To calculate the unlevered beta of a company, the debt effect has to be removed from the levered beta – the debt effect can be computed by multiplying the D/E ratio by (1- Tax .

levered beta formula Passaggio 2: scopri l'aliquota fiscale per l'organizzazione. L'aliquota fiscale è rappresentata da t. Passaggio 3: scopri il debito totale e il valore del patrimonio netto. Passaggio 4: calcolo del beta unlevered utilizzando la formula: Beta unlevered = Beta con leva (1 + (1-t) (debito / capitale)) Esempi di Levered Beta Formula The conversion between levered and unlevered beta involves intricate formulas that hinge upon crucial inputs such as the corporate tax rate, total debt, and total equity. These calculations facilitate a seamless transition between these beta variations, aiding in a more accurate assessment of a company's risk profile. Levered beta is characterized by two components of risk: . Formulas, Examples. A coverage ratio measures a company's ability to service its debt and meet its financial obligations. In finance, Beta measures the volatility of a stock compared to the overall market. However, when we look deeper into Beta, we encounter two different versions: Levered Beta and Unlevered Beta.These two types of beta allow us to assess a company's risk profile depending on whether or not it includes the impact of financial leverage (debt).

Here, Company A has a beta of 1.2. Now, you will have to unlevered the beta of Company A. in simple language; you have to remove the effect of leverage from the beta of company A. By applying the formula, we find the unlevered beta value to be 0.91. Unlevered Beta (βCompany A) = Levered Beta (βCompany A) / {1+(1-Tax)*(Debt/Equity)}

The industry beta approach looks at the betas of public companies that are comparable to the company being analyzed and applies this peer-group derived beta to the target company. This approach eliminates company-specific noise. It also enables one to arrive at a beta for private companies (and thus value them). Unlevered to Levered Beta Formula When the levered beta is unlevered it may move closer to 1 or even be less than 1. Professional analysts in investment management, investment banking, . The formula adjusts the levered beta by removing the effect of debt, providing a more accurate representation of the company’s underlying business risk. By understanding each component of the formula, investors and analysts can gain a deeper understanding of how to calculate unlevered beta and make more informed investment decisions. Finance, Seeking Alpha or Google Finance and then applying the following formula: Unlevered Beta = Levered Beta / [1 + (1 – Tax Rate) * (Debt / Equity)] This page is advertising for FinancialTemplateStore.com. You can buy the Beta calculation template at their store by by clicking on the button below or click here.

Hamada's formula is presented as follows: $$\beta_{U}=\left[\frac{1}{1+\frac{D}{E}(1-\tau)}\right]\beta_{L},$$ where $\beta_{U}$ and $\beta_{L}$ are the unlevered and levered betas of a firm . Skip to main content. Stack Exchange Network. Stack Exchange network consists of 183 Q&A communities including Stack Overflow, .